If you, like many others in Southwest Florida, had your home damaged by Hurricane Ian, you may be asking yourself: “Can I still sell a property damanged by a hurricane?” This is a common question for those affected by the devastating storm that was Hurricane Ian.

Understanding the Impact

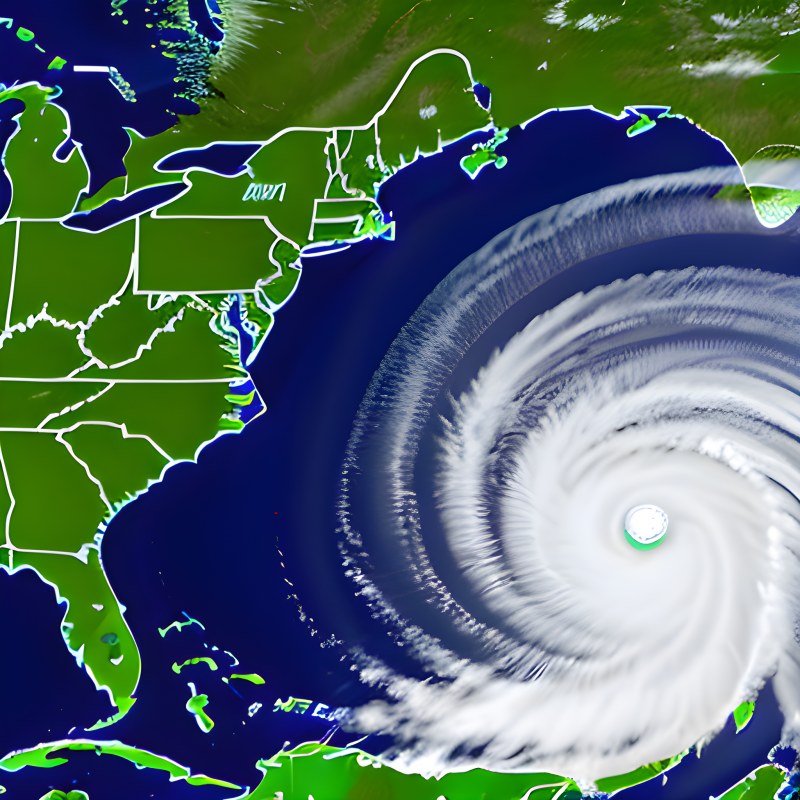

First, let’s remind ourselves of the magnitude of this event. On September 28th, 2022, Hurricane Ian struck as an incredibly powerful Category 4 hurricane. Wind speeds hovered tantalizingly close to the threshold of a Category 5 storm — just two miles per hour short. Sustained winds at 155 miles per hour and gusts estimated above 185 miles per hour made this storm absolutely devastating.

Hurricane Ian has claimed over 152 lives and caused upward of $113 billion in damage — an amount that continues to rise. It stands as the deadliest storm to hit Florida since the infamous 1935 Labor Day Hurricane which hammered the Florida Keys. This unforgiving tempest could potentially become the costliest hurricane ever to hit the Florida peninsula.

The aftermath of Hurricane Ian will undoubtedly shape Southwest Florida for years to come. Still, if you’re wondering whether now is an appropriate time to sell your property despite its wind or storm-surge damages, keep reading — we have some surprising insights for you!

Selling Damaged Property: Yes, You Can… But…

You can sell your property whenever you choose regardless of its condition; however, there are some caveats when dealing with severely damaged properties. Typically families seeking mortgages can only complete their purchases if your property is in lendable condition (i.e., it possesses all necessary systems for immediate occupancy). Factors hindering buyers from obtaining a mortgage could include severe roof damage rendering it uninsurable, dangerous wiring situations or plumbing issues, no running water or inability to properly secure the property due to missing or damaged doors and windows.

If your property is currently under repair through insured means or work carried out by licensed professionals — yes! It’s possible to bring these items into good working order while under contract and still close on it. However, should delays occur during repairs these might cause closing postponements or even allow buyers to abandon their purchase - dependent on contractual specifications.

Cash Transactions: A Viable Solution

Even if parts of your damaged property weren’t insured or some necessary repairs were not covered insurance-wise – don’t despair! Roughly one-third of all transactions in Florida are cash transactions – either involving buyers who can foot 100% of listing prices upfront or investors who’ve secured alternative financing options (often non-traditional loans) aiming at purchasing and repairing homes for future market sale or long-term rental investment.

Cash transactions generally bypass many lendable condition restrictions posing challenges for properties requiring significant repair work. This implies that YES - you can indeed list your damaged property on MLS (Multiple Listing Service) with an experienced REALTOR’s assistance who’ll help find suitable cash buyers while securing optimal sales price/terms aligned with your needs.

Sellers often find such transactions easier than typical mortgage purchases as cash buyers frequently waive inspection requirements; they purchase properties ‘as-is’, without demanding pre-sale repairs and often manage closures within mere days once clear title assurance has been granted. So not only does selling significantly repaired properties remain viable but such transactions often conclude much faster than traditional sales!

Here comes another surprise – in most cases even if insurance covered damage costs you’re free to sell ‘as-is’ AND pocket any insurance settlement checks!

Wrapping Up

Navigating real estate after a natural disaster may seem daunting but it’s certainly possible – even advantageous in certain scenarios! If this article was helpful feel free check out more Real Estate articles and subscribe here for our curated newsletter covering latest trends in Florida Real Estate.